Tell the IRS Only What They Need to Know

I’m interested in helping you keep your money. Every step of the way, my tax resolution guidance is geared towards my client paying the absolute minimum amount of legal tax. There are many ways I do this.

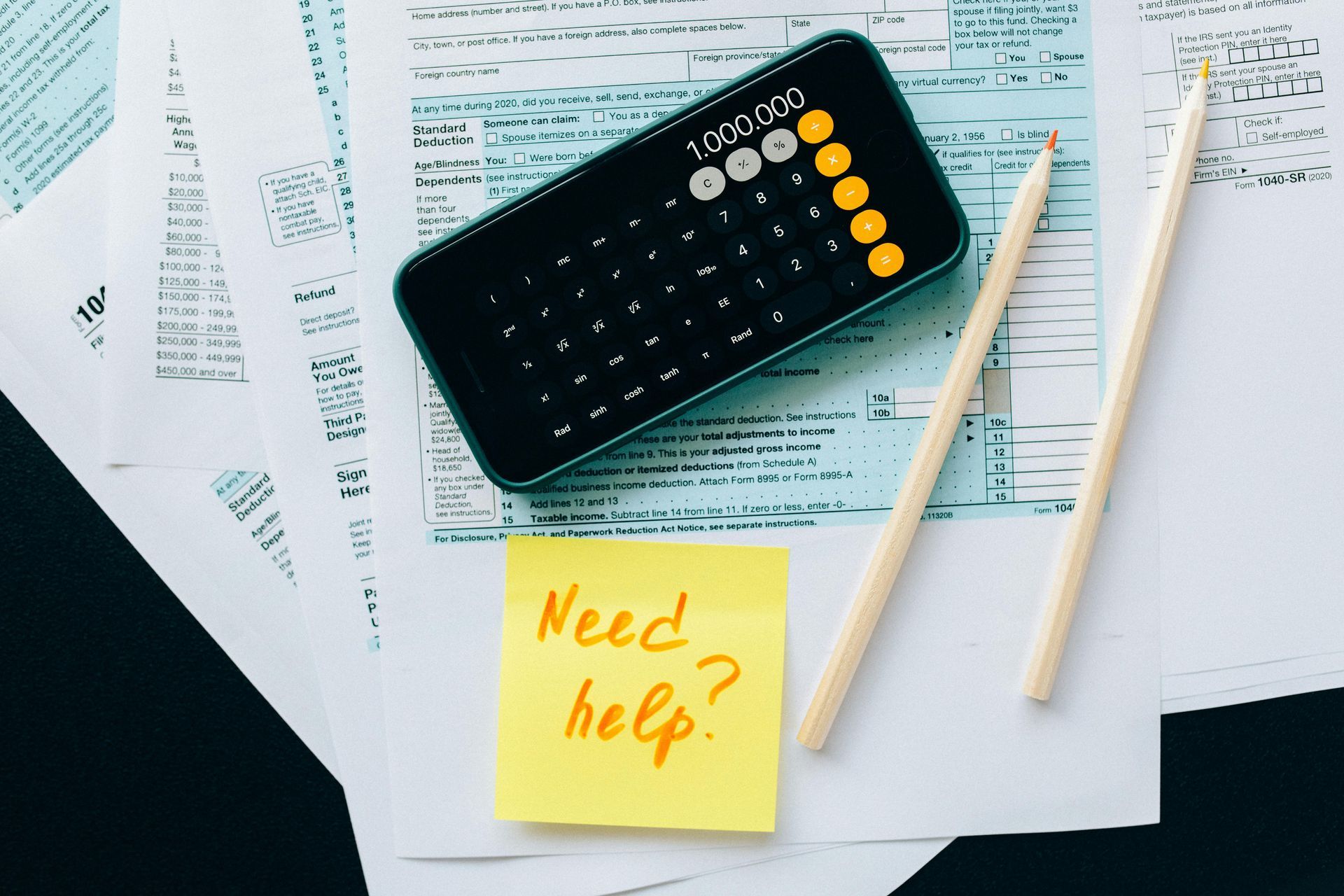

First, as a tax resolution expert, I make sure the IRS complies with all tax regulations and their own internal protocols. I know the rules and regulations that govern the IRS and I put them to use in every case. Here are some common situations where I can intervene in a client’s case:

➡️ When an IRS decision creates a hardship for my client. I make sure information about my client’s circumstances–especially if payment of a debt would create unusual financial difficulties–is communicated to the IRS officer. I tally all of my client’s basic expenses, like transportation to and from work and maintaining a place to live, and give the IRS a full report. If an IRS decision about debt payment is too burdensome for my client, I appeal.

➡️ When the IRS files a tax lien on a client’s property or bank account, I strongly advocate for a client’s position and raise objections. I insist that the IRS give us a response if they do not agree with our position.

➡️ If an IRS agent attempts to extract too much information from a client. I make sure the IRS agent follows the law and isn’t unnecessarily intrusive in his or her request for information. My perspective is: There’s no need to disclose more than the minimum of information necessary to resolve a client’s case.

➡️ If an IRS debt calculation is wrong. I always assemble a client’s paperwork and determine the debt owed plus interest and penalties. There may be a discrepancy in the IRS’s calculation of a client’s debt or a wage garnishment. I make sure we have a watertight record of what has been paid and what is owed.

The IRS has its own regulations, processes, and language. I’ve spent 20 years learning why and how the IRS operates. It’s a system that requires experience to navigate. I bring that experience to your situation. Together we can resolve your tax debt.

Let me help you keep your money. Schedule a consultation now.

Please complete the form below and we'll set up an appointment for you.