Keep Your Money–Tax Resolution Saves Time and $$

If there’s one truth about IRS tax debt, it’s that it can happen to anyone, regardless of one’s income.

A simple mistake can start the ball rolling and before you know it, a small IRS debt has snowballed into a big one because of added penalties and interest.

I want to ease your stress–and help you keep your money.

I am a tax resolution expert. Every year I must take a test showing that I know the rules and regulations of the IRS and how they apply to the treatment of taxpayers.

Most tax professionals do not want to call the IRS. I love to call the IRS and settle my clients’ accounts.

What I do is tell the IRS your story. I collect evidence that your money was spent appropriately and show documentation of your attempts to pay what you owe. If the IRS decides against you, I appeal. Or, if circumstances allow, I negotiate an offer in compromise. That means the IRS lets you pay less than what you owe in order to settle your debt.

Look at the results: negotiating an offer in compromise can sometimes reduce your debt. This has happened for many of my clients!

And what if that snowball problem is not your fault? I put together a record to show the facts.

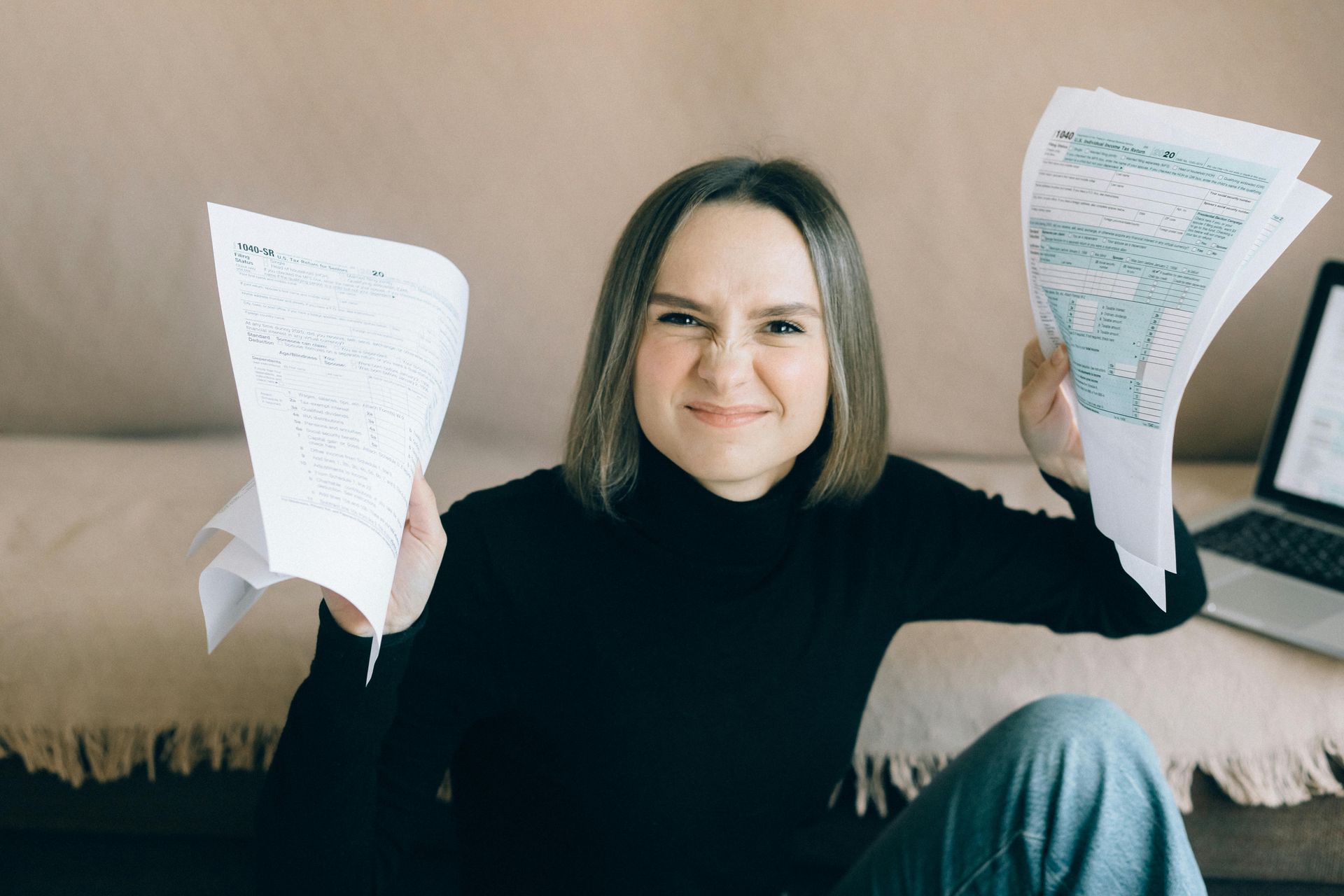

Here’s one happy client who saved thousands of dollars because of my services:

“I was audited by the IRS regarding an issue that was an oversight by my previous tax preparer. Ralph Nelson of Financial Harmony took responsibility for dealing with the IRS. His excellent work saved us thousands of dollars, as well as doing all the dealings with the IRS.” – Hank S., Hayward, CA

Put your mind at ease. I have helped hundreds of clients and I can help you too. With tax resolution expertise, you can save money and solve your tax problems. Contact me today.

Please complete the form below and we'll set up an appointment for you.