Stop Wage Garnishments and Keep Your Money

A wage garnishment or an IRS garnishment of your bank account can be very stressful. I’ve had innumerable clients come to me in a panic, at the end of their ropes. The inexplicable IRS paperwork, frustrating waits on the phone to speak to a representative, and the panic and worry of understanding the process had them turned upside down.

After 20 years of experience working through these situations, however, I know that there’s light at the end of the tunnel. You will find relief. That’s why I’m here.

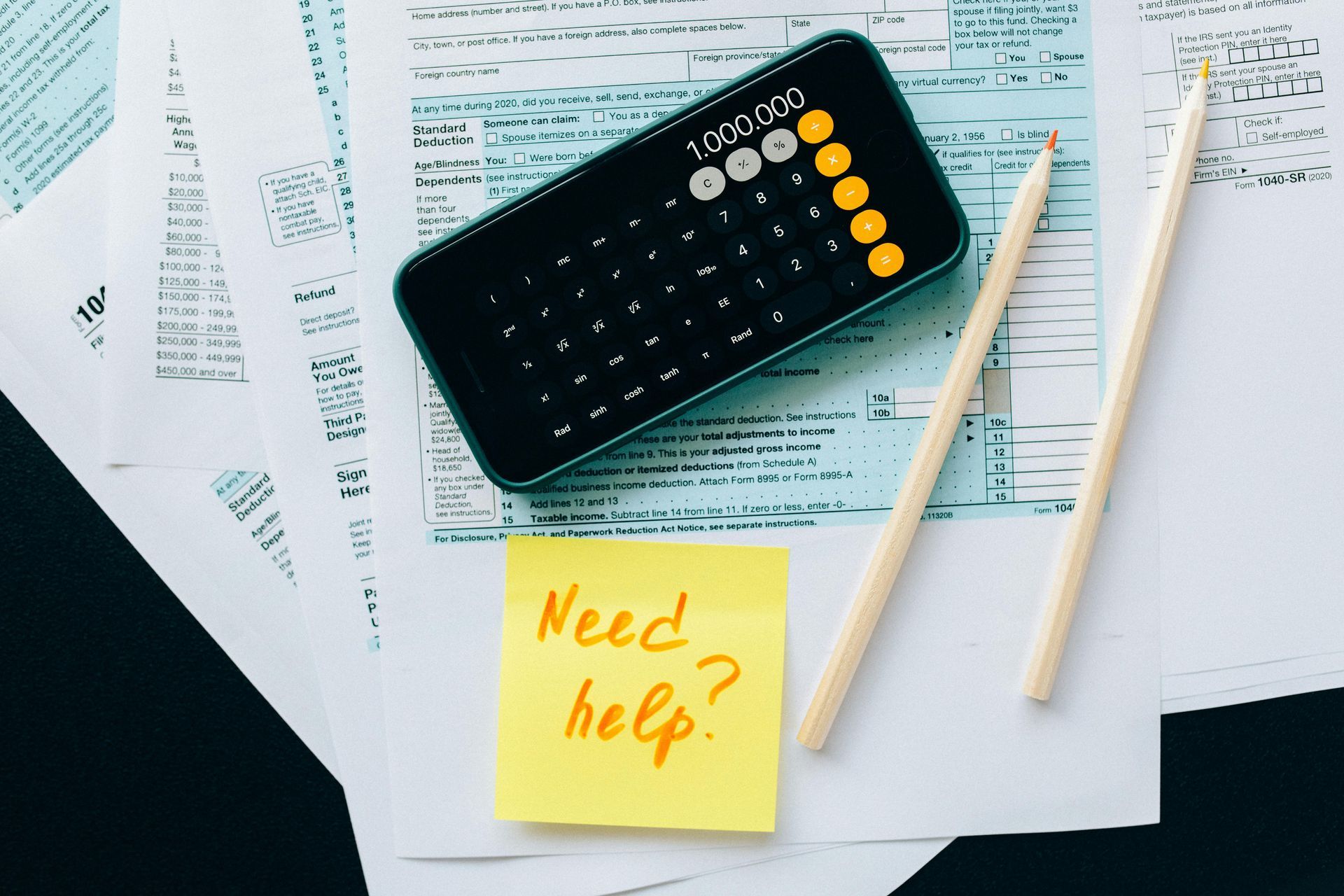

The first thing I do for clients facing a wage garnishment is to make sure that the client actually owes what the IRS says they do. The second thing I advise clients about is how to pay down the debt: it’s best to pay the IRS debt down as soon as possible, depending on the client’s finances. Sometimes, when all the returns are filed and the liability is lowered, we find out the client has paid their full tax bill and an IRS refund is owed.

The fact is, there are so many IRS regulations and rules for both the IRS agent and the taxpayer to follow, that the system requires its own expertise. In order to file back taxes and clear your tax debt, your tax expert works with the IRS. This saves you hours of time filing IRS paperwork and calling the IRS.

I had a client–a married couple–with 6-8 years of unfiled taxes. Their tax issues had come to a head because they needed to file a financial aid form for their daughter, who was applying to college. Although the couple made good money, they were losing money every month from an IRS wage garnishment. That doesn’t mean the IRS takes only what they’re owed–they are also charging interest on the debt. Once I sorted through my clients’ paperwork and calculated their tax returns, it turned out they had been entitled to a $50,000 tax refund!

However, my clients were not able to claim their refund because they filed such a late IRS tax return–too late to qualify for the IRS refund. I understand why tax paperwork ends up late and that’s why I’m here: To help people get this elephant off their back–and keep their money!

The upside of fixing your tax problems is that when you get rid of IRS debt, you get your life back. I’ve seen it many times: when I tell a client their debt is resolved, their shoulders drop with relief and their eyes dance with delight. Their lives can restart and their joy is wonderful to witness.

I love talking to the IRS on your behalf! Contact me now for a consultation.

Please complete the form below and we'll set up an appointment for you.