Offer in Compromise – Introduction

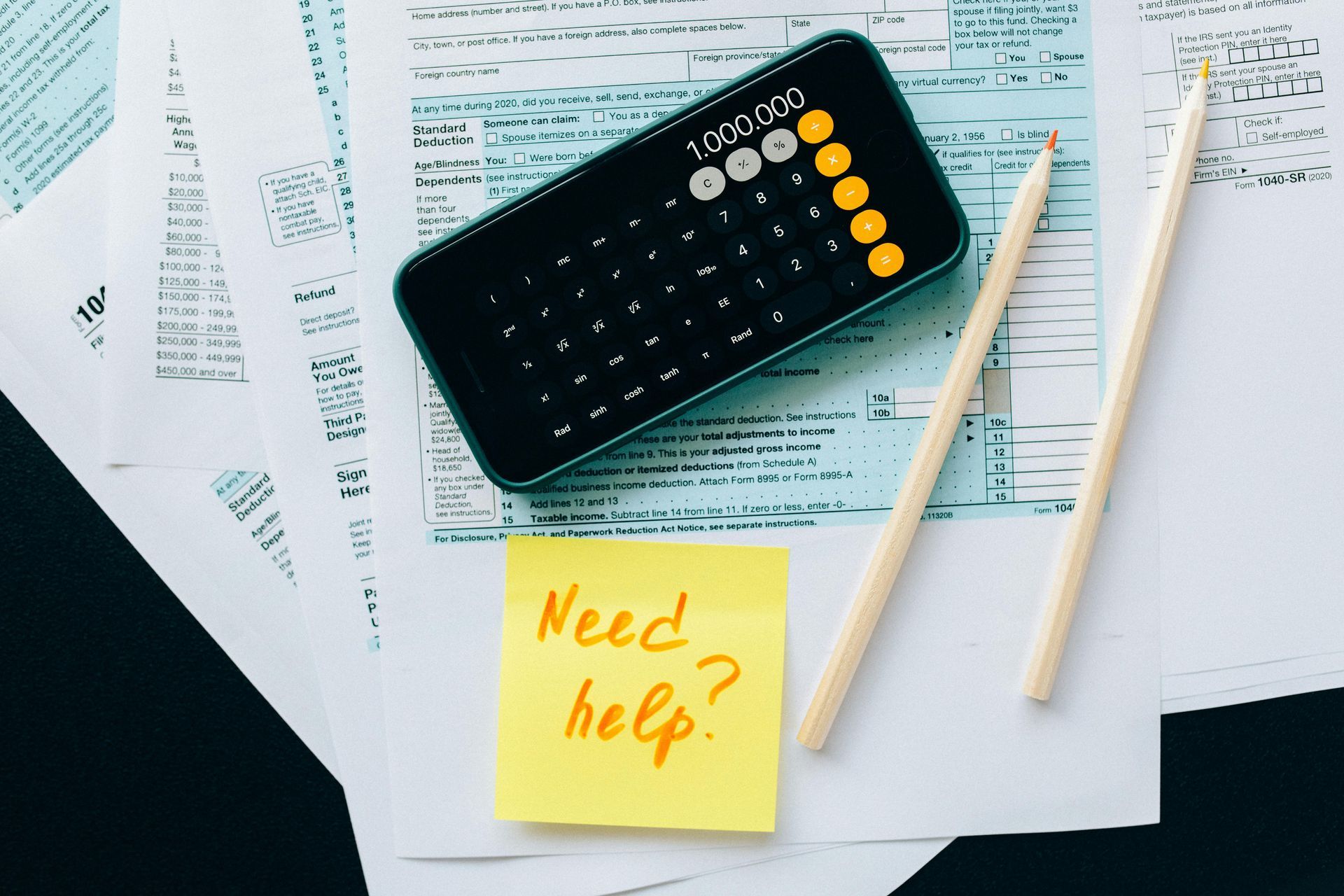

The road to tax relief can sometimes be traveled by filing an Offer in Compromise, or OIC, with the Internal Revenue Service. An OIC is a proposal to the IRS.

IRS Tax Relief Could Mean That You Pay Less than What You Owe

The road to tax relief can sometimes be traveled by filing an Offer in Compromise, or OIC, with the Internal Revenue Service. An OIC is a proposal to the IRS. You are asking them to allow you to pay less than what you owe. Example: You owe the IRS $125,000 and you file an OIC with an offer to pay $35,000. If they accept it you will only pay $35,000 and your IRS debt will be permanently settled. You have two pay-back options when your offer is accepted. You can pay back the money within five months or twenty four months. The twenty four months will require a larger amount.

Convincing the IRS that you are qualified to pay less than what you owe

Getting the IRS to let you pay less than what you owe, will, of course, be a difficult path to travel. However, the rules that you need to follow are pretty straight forward and, if you follow them correctly you will dramatically increase your odds of being successful. In this, and later posts, you will learn the necessary steps to follow when filing an OIC. You will also learn some “Tricks of the Trade”, that are not listed in the IRS booklets, that will help you lower the amount that you offer. These rules require that you are aware of the current “National Standards” that change every year.

Five basic parts to filing an Offer in Compromise

This first blog post will show you an outline of the five basic parts of an OIC package that meets or exceeds the IRS requirement. In later blogs you will find more information to help you understand each of the five parts.

Those parts are:

- Assets

- Income and expenses

- Becoming current with all tax return filings and estimates

- Documentation of every number

- Assembly of the package so that anyone can understand what you’ve put together

When you use these five parts and put together an OIC package that is exactly what the IRS wants, you will have a much better chance of being successful and you will be more likely to get the tax relief you want. Most OICs are rejected by the IRS because the paperwork is not filled out correctly. In later posts you will learn how to correctly fill out paperwork.

Tax relief is more likely if you follow these five basic parts. And we will show you how to do that in the following blog posts.

Please complete the form below and we'll set up an appointment for you.