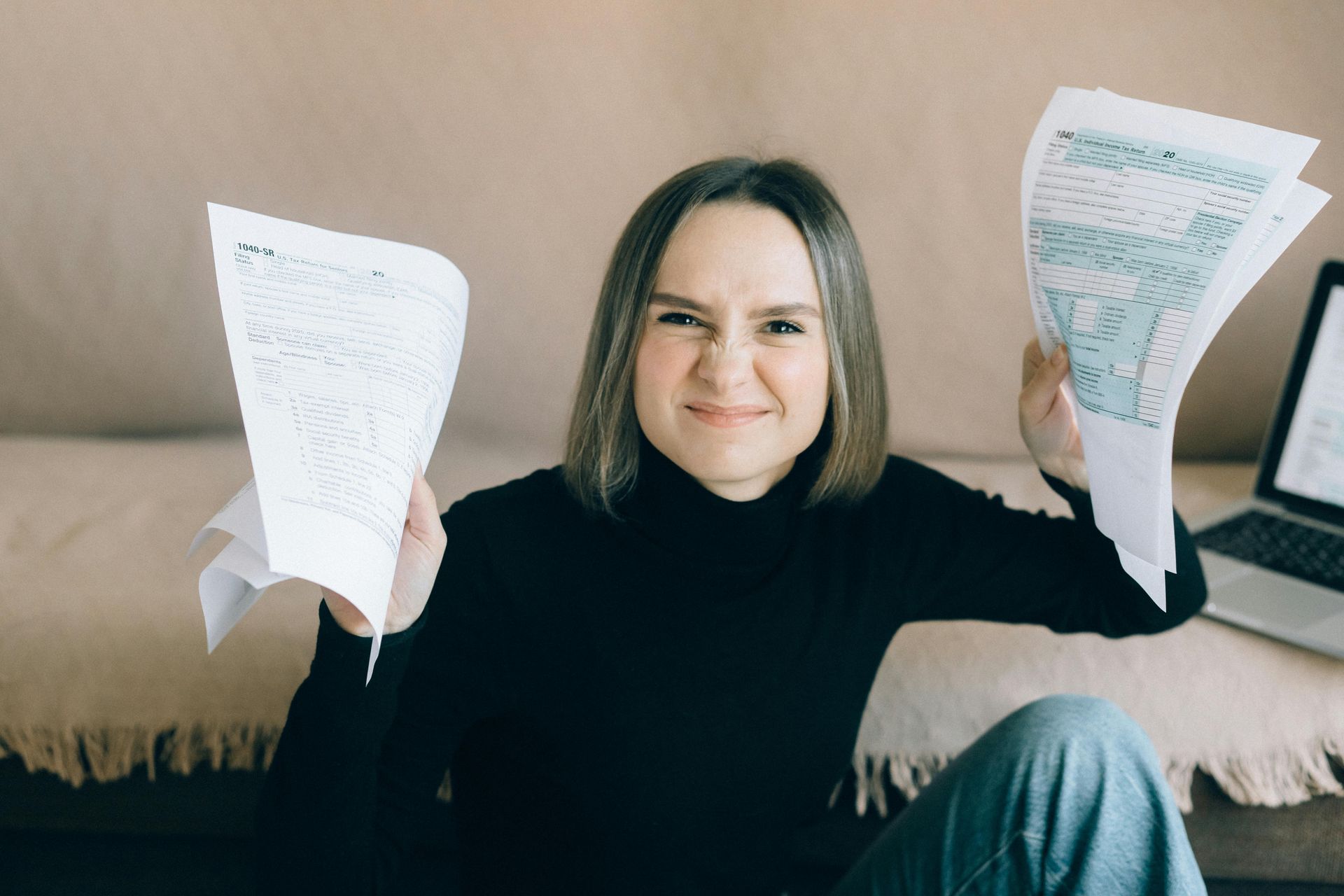

Reclaim Your Life

Schedule Your

FREE CONSULTATION

Schedule Your

FREE CONSULTATION

Please complete the form below and we'll set up an appointment for you.

Thank you for contacting us.

We will get back to you as soon as possible.

There was an error sending your message. Please try again or email us at taxhelp@financial-harmony.com.

Slide title

“ I was audited by the IRS regarding an issue that was an oversite by my previous tax preparer. Ralph Nelson took responsibility for dealing with the IRS. His excellent work saved us thousands of dollars, as well as doing all the dealings with the IRS. Financial Harmony Tax Resolution stays up with the changes in the tax code each year so that its clients can benefit.”

- Hank S.

Hayward, CA

Button

Slide title

"Ralph Nelson of financial harmony really came through for us with our taxes. He dug in, filed the appropriate paperwork for our extension, he worked several different scenarios for us and talked my very examiner husband through everything in a low key and cheerful manner. He has a very good bedside manner which is something we have struggled to find in an accountant. Money can be a very challenging topic for us as I'm sure it is for many people. Just want to let everyone know that he's great to work with."

Marie B.

Berkeley, CA

Button

Slide title

"My wife and I, both small business owners, had gotten a late start on our taxes and also wanted to explore multiple filing options. We contacted Financial Harmony as suggested by a friend. We couldn’t have been more pleased by the professionalism and level of care displayed by Financial Harmony and plans to work with them for years to come."

- Brad G.

Emeryville, CA

Button

Slide title

"I went to Ralph at a time of crisis: my business and savings had been devastated by the recession, and then I had a very serious cancer diagnosis. Ralph understands systems. While I concentrated on physical survival, he dealt with the IRS and state. In a remarkably short time, my tax situation was completely resolved."

- Susan L.

Berkeley, CA

Button

Slide title

"Ralph gets my returns done quickly, is very good at answering all my questions and is patient when I make mistakes."

- Jane Eisenstark

Button

Slide title

“I felt comfortable recommending Ralph to a friend because he can transform the feeling of being beat down by the IRS and has great skill in what he does."

- Catherine B.

Button

Slide title

“Ralph is very easy to work with and took the time to help answer any questions. :)”

- Christopher B.

Hayward, CA

Button

Slide title

“Very knowledgeable and trust worthy. I recommend Financial Harmony highly.”

- Gloria M.

Hayward, CA

Button

FINANCIAL HARMONY TAX RESOLUTION WINS

Offer in Compromise

- Debt $509,000

- Settled for $18,725

- Saved $490k

Offer in Compromise

- Debt $385,812

- Settled for $11,844

- Saved $374k

Offer in Compromise

- Debt $49,973

- Settled for $22,060

- Saved $28k

Audits/Late Filing Representation

- Debt $64,811

- Settled for Refund of $308

- Saved $65k

Audits/Late Filing Representation

- Debt $78,017

- Settled for $13,905

- Saved $64k

Audits/Late Filing Representation

- Debt $103,870

- Settled for $0

- Saved $104k

Offer in Compromise

- Debt $227,011

- Settled for $10,245

- Saved $374k

Offer in Compromise

- Debt $112,489

- Settled for $1,132

- Saved $111k

Audits/Late Filing Representation

- Debt $131,820

- Settled for $68,294

- Saved $64k

Offer in Compromise

- Debt $509,000

- Settled for $18,725

- Saved $490k

Offer in Compromise

- Debt $385,812

- Settled for $11,844

- Saved $374k

Disclaimer: Every client’s situation is different. I fight hard to find the best legal path forward—but your results will depend on your full financial picture and current IRS rules.

Welcome To

Financial Harmony Tax Resolution

Based in El Cerrito, California and proudly serving the San Francisco Bay Area, the state of California, and nationwide, Financial Harmony Tax Resolution specializes in turning your tax challenges into solutions that bring you peace of mind. Whether you're facing back taxes, penalties, or need help with filing current or past tax returns, Smiley Ralph Nelson, Enrolled Agent, and his team are here to guide you through every step of the process. With over 28 years of tax resolution experience, Smiley is committed to achieving the best possible outcome for you, helping you resolve your IRS problems and regain control of your finances. We offer a compassionate, professional approach that focuses on achieving the best outcomes —allowing you to move forward with confidence.

Schedule a consultation today to discover how we can help you achieve the financial freedom you deserve.

Ready to resolve your tax issues and move forward with peace of mind?

Financial Harmony Tax Resolution offers the expert guidance you need to get back on track and achieve the financial freedom you deserve.

and let's find the best solution for you.

ABOUT

SMILEY RALPH NELSON, EA

"Your IRS Debt Has Nothing To Do With The Goodness Of Your Soul"

Smiley Ralph Nelson, Enrolled Agent and founder of Financial Harmony Tax Resolution, has dedicated his career to helping individuals and small businesses navigate the complexities of the IRS and state tax systems. With over 28 years of experience and a deep passion for customer satisfaction, Smiley offers expert tax resolution services with a focus on achieving positive outcomes.

As an Enrolled Agent (EA), Smiley has the highest qualifications to represent you before the IRS and other tax authorities. He’s worked with clients from all walks of life, helping them resolve tax issues, reduce debt, and regain peace of mind. Smiley believes in building long-term relationships with his clients, providing them with the knowledge and tools to stay on top of their taxes moving forward.

HOW IT WORKS

We know that resolving tax issues can feel complicated, but our process is designed to simplify it for you. Here's how we focus on delivering results:

Step 1: Initial Consultation

Our first step is a private, no-pressure consultation to fully understand your tax situation and goals. We'll set clear expectations and discuss your options.

Step 2: Review of Your Situation

You will sign Powers of Attorney, and Financial Harmony Tax Resolution (FHTR) will order your IRS and state transcripts. FHTR will then access your accounts at each agency and use the information on we obtain to determine the problems with your personal and/or business accounts. We will then examine your finances and couple the IRS/State perspective with your finances to see the best path forward.

Step 4: Negotiation and Filing

The Analysis will tell us how many tax returns (if any) are required to bring you into compliance. Tax preparation is a separate fee and contract from the Analysis. The amount of late returns and the cost for each return will be determined in the Analysis.

Tax Resolution Work

Once we have finished the Analysis and Tax Return Preparation, you and FHTR will

determine the resolution that best fits your situation. This will be a separate contract and

fee from the Analysis. Resolution options include a properly structured Installment

Agreement, an Offer in Compromise, placement into Currently Not Collectible status, and others. Once we settle the problems, you will not need to talk to the IRS/FTB again.

Step 5: Ongoing Support

Once your tax problems are resolved, we continue to provide advice and support to help you maintain compliance and avoid future tax issues.

From start to finish, our goal is to provide clear, effective solutions that relieve your tax burdens.

Take the first step toward a solution by scheduling your consultation today.

Tax Resolution & Tax Filing Services

At Financial Harmony Tax Resolution, our services are designed to provide effective and lasting solutions to your tax issues. We tailor our approach to fit your specific situation, ensuring the best outcome for you. Here's how we can help:

Offer in Compromise

We work to reduce your tax debt to a manageable amount, so you don't have to carry the full burden if you're unable to.

Installment Agreements

If you need more time to pay, we negotiate affordable payment plans that make sense for your budget.

Currently Non-Collectible Status

If you're facing financial hardship, we may be able to help you temporarily halt collections until your situation improves.

Tax Filing

We work to reduce your tax debt to a manageable amount, so you don't have to carry the full burden.

IRS Audits

If you're facing an audit, we’ll represent you to ensure fair treatment and work to resolve any discrepancies, potentially lowering your liability.

Previous Year Tax Filing

If you're behind on filing, we’ll help you catch up quickly and efficiently, so you can stop accumulating penalties and move forward.

With Smiley's expertise, you'll see tangible result, and you can trust we're always working toward the best possible resolution for your tax situation.

Reach out now to start solving your tax problems today.

COMMON TAX RESOLUTION PROBLEMS & SOLUTIONS

At Financial Harmony Tax Resolution, we focus on delivering actionable solutions for common tax challenges, ensuring you get the best results:

Unfiled Tax Returns

If you're behind on filing, we’ll help you catch up quickly and efficiently, so you can stop accumulating penalties and move forward.

Tax Debt

If you owe taxes you can’t afford to pay, we’ll negotiate an Offer in Compromise or arrange a manageable Installment Agreement to make your debt more affordable.

IRS Audits

If you're facing an audit, we’ll represent you to ensure fair treatment and work to resolve any discrepancies, potentially lowering your liability.

IRS Liens and Levies

If the IRS has taken action against your property or accounts, we work to remove liens and levies, so you can get back on track.

Penalties and Interest

We focus on reducing penalties and interest, lowering your overall tax burden and helping you save money.

Our commitment is to help you find the best solution for your tax issues, so you can get back to living your life without the burden of tax stress.

Contact us today to discuss your specific tax resolution needs.

Our Blog: Tax Insights

Privacy & Terms

All Rights Reserved | Financial Harmony Tax Resolution